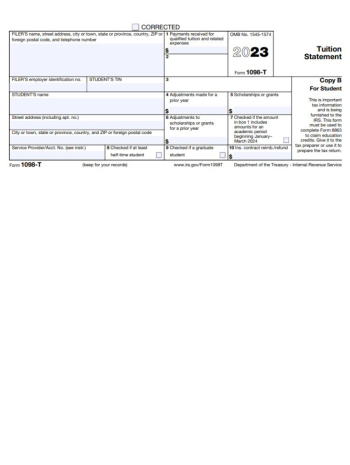

Form 1098-T for 2023

Get Now2023 Form 1098-T: Short Guide

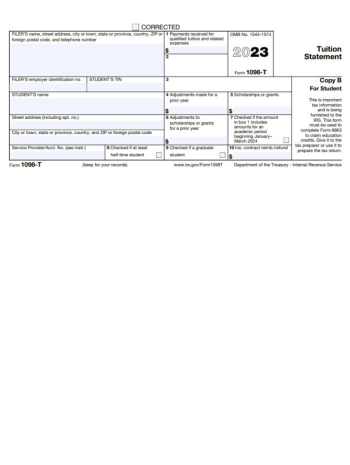

The 1098-T tax form is a document that many taxpayers encounter when filing their annual tax returns, particularly those who have invested in higher education. This crucial form, also known as the Tuition Statement, is typically provided by educational institutions to both the student and the Internal Revenue Service (IRS). Simply put, the 1098-T tuition statement for 2023 serves as a record of the tuition and related expenses paid during the tax year and is instrumental in determining eligibility for education-related tax credits and deductions, such as the American Opportunity Tax Credit or the Lifetime Learning Credit.

The 1098-T Tuition Statement Form Latest Revision

As with any tax document, the 1098-T can undergo changes from year to year. For the 2023 tax year, it's essential that students and their families pay close attention to any alterations in the form's requirements, which may affect how they claim education credits and deductions. These changes could include adjustments to reporting methods, updated thresholds for deductible amounts, or modifications to qualifying educational expenses. Such changes may influence the tax benefits received and the amount of deductible educational expenses on one's tax return.

The 1098-T Tax Form Assignments

Not everyone is eligible to receive a blank 1098-T form for 2023, as there are specific criteria that must be satisfied.

- Generally, the form is issued to students enrolled in an eligible educational institution that maintains a program leading to a degree, certificate, or other recognized educational credential.

- Additionally, the students must have incurred reportable transactions during the calendar year, such as tuition and certain related expenses.

- Note that the 2023 1098-T tax form is not issued to students whose expenses are waived or paid entirely with scholarships, those who are non-resident aliens, or those whose courses do not offer academic credit.

Benefits of the Fillable 1098-T Form

To make the most out of the 1098-T fillable form for 2023, taxpayers should ensure they are accurately reporting all eligible educational expenses. It's important to consult with a tax professional or use reliable tax software to claim the correct amounts on the tax return. It's also beneficial to keep detailed records of all related expenses that might not be reflected on Form 1098-T, as some additional costs may also qualify for credits or deductions.

When it comes to filing taxes, accessing the tax form 1098-T for 2023 is just the beginning. One must be proactive in understanding how to utilize the information it provides. Being well-informed about the potential tax benefits associated with education expenses can substantially reduce one's taxable income and potentially increase the value of a tax refund. Review all guidelines or speak to a tax advisor for the most current and applicable advice.

Related Forms

-

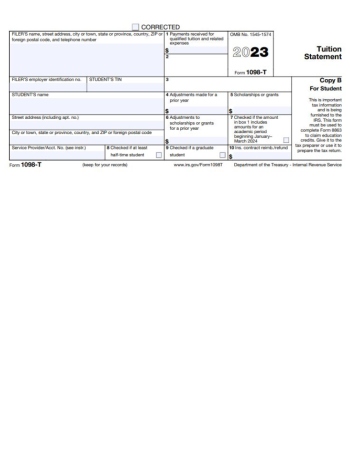

![image]() 1098-T IRS Form 1098-T is a crucial document for students and educational institutions in the United States, providing detailed information regarding qualified tuition and related expenses. The form serves as a statement that universities and other eligible educational establishments send to the student and the Internal Revenue Service. Additionally, the 1098-T statement plays an integral role during the fiscal season, as it allows students to determine if they qualify for the American Opportunity Cred... Fill Now

1098-T IRS Form 1098-T is a crucial document for students and educational institutions in the United States, providing detailed information regarding qualified tuition and related expenses. The form serves as a statement that universities and other eligible educational establishments send to the student and the Internal Revenue Service. Additionally, the 1098-T statement plays an integral role during the fiscal season, as it allows students to determine if they qualify for the American Opportunity Cred... Fill Now -

![image]() IRS Form 1098-T (PDF) The IRS tax form 1098-T is a critical document for students and educational institutions in the United States, particularly when tax season arrives. This form, known officially as the "Tuition Statement," is essential for reporting tuition expenses and calculating potential education credits that students may be eligible for on their tax returns. The purpose of IRS tax form 1098-T in PDF is to help students make accurate claims regarding the tuition and fees paid to eligible educational institutions, ensuring that they can take full advantage of educational tax benefits. Getting To Know the 1098-T Tax Form for 2023 For students and tax preparers seeking convenience, the 1098-T form for 2023 in PDF provides a modifiable and digital variant that can be filled out directly on a computer. This editable PDF format allows users to input their information neatly and efficiently, preventing errors often occurring when completing paper forms by hand. Moreover, it offers the flexibility to save progress and return later, adding or correcting information as needed. The digital format of the 1098-T in PDF is designed to streamline the process of filing taxes and claiming education-related credits. Challenges of Filing the 1098-T in PDF Online When submitting the 1098-T in PDF form online, some may encounter challenges. It is important to ensure that the completed form meets the necessary electronic filing requirements set by the IRS. Technical issues such as incompatible software, incorrect formatting, or failed uploads can also be potential obstacles. It is crucial to have a reliable internet connection and use updated programs that can handle PDF forms. Additionally, users must be careful about the security and privacy of their personal information while completing and submitting the form online. Top Tips For Flawless Online Submission To complete and submit the PDF 1098-T template, there are several best practices to remember. First, ensure you have the latest version of a PDF reader installed on your computer. This software will help open, complete, and save the PDF version of the form seamlessly. Users should double-check all entered information for accuracy to avoid common errors that can lead to processing delays or incorrect tax benefits. It is also wise to keep a printed copy of the completed form for your records. Always verify the submission guidelines on the IRS website or with your educational institution to ensure you comply. Securing your data is paramount, so consider using secure platforms and encryption when submitting your 1098-T form in PDF online. Lastly, be mindful of the tax filing deadline, as late submissions could lead to missed benefits or penalties. By following these recommendations, submitting your 1098-T form should be efficient, secure, and hassle-free. Remember, investing a little extra effort into completing and submitting your IRS tax form can significantly impact your tax obligations and educational financing planning. Fill Now

IRS Form 1098-T (PDF) The IRS tax form 1098-T is a critical document for students and educational institutions in the United States, particularly when tax season arrives. This form, known officially as the "Tuition Statement," is essential for reporting tuition expenses and calculating potential education credits that students may be eligible for on their tax returns. The purpose of IRS tax form 1098-T in PDF is to help students make accurate claims regarding the tuition and fees paid to eligible educational institutions, ensuring that they can take full advantage of educational tax benefits. Getting To Know the 1098-T Tax Form for 2023 For students and tax preparers seeking convenience, the 1098-T form for 2023 in PDF provides a modifiable and digital variant that can be filled out directly on a computer. This editable PDF format allows users to input their information neatly and efficiently, preventing errors often occurring when completing paper forms by hand. Moreover, it offers the flexibility to save progress and return later, adding or correcting information as needed. The digital format of the 1098-T in PDF is designed to streamline the process of filing taxes and claiming education-related credits. Challenges of Filing the 1098-T in PDF Online When submitting the 1098-T in PDF form online, some may encounter challenges. It is important to ensure that the completed form meets the necessary electronic filing requirements set by the IRS. Technical issues such as incompatible software, incorrect formatting, or failed uploads can also be potential obstacles. It is crucial to have a reliable internet connection and use updated programs that can handle PDF forms. Additionally, users must be careful about the security and privacy of their personal information while completing and submitting the form online. Top Tips For Flawless Online Submission To complete and submit the PDF 1098-T template, there are several best practices to remember. First, ensure you have the latest version of a PDF reader installed on your computer. This software will help open, complete, and save the PDF version of the form seamlessly. Users should double-check all entered information for accuracy to avoid common errors that can lead to processing delays or incorrect tax benefits. It is also wise to keep a printed copy of the completed form for your records. Always verify the submission guidelines on the IRS website or with your educational institution to ensure you comply. Securing your data is paramount, so consider using secure platforms and encryption when submitting your 1098-T form in PDF online. Lastly, be mindful of the tax filing deadline, as late submissions could lead to missed benefits or penalties. By following these recommendations, submitting your 1098-T form should be efficient, secure, and hassle-free. Remember, investing a little extra effort into completing and submitting your IRS tax form can significantly impact your tax obligations and educational financing planning. Fill Now -

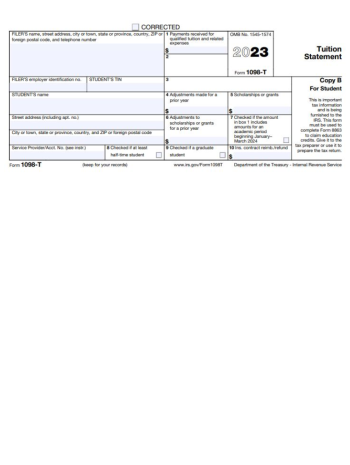

![image]() 1098-T Form Instructions It's essential to stay informed on tax forms and their applications to manage your yearly filings better. One form that often comes into play for students or parents is the IRS Form 1098-T. This particular document serves a vital purpose in the United States tax system, playing a significant role for those involved with higher education expenses. Educational institutions use it to report the amount of expenses paid by a student during the tax year. It's important to note that this form is not just necessary, but it's often mandatory for any taxpayer who wishes to claim education credits like the American Opportunity Credit or the Lifetime Learning Credit. Filling Out Form 1098-T: Key Elements When dealing with the 1098-T form instructions, it is crucial to focus on several critical elements to ensure accurate reporting and to maximize potential tax benefits: Box 1: This box reports the amount of qualified tuition and other expenses paid during the tax year. Box 2: This box is used to show amounts billed for qualified tuition and related expenses but has been phased out in favor of reporting actual payments. Box 5: Scholarships or grants received; these are subtracted from your qualified expenses since they represent amounts that do not need to be repaid. Box 8: Indicates if you are enrolled at least half-time in a degree program, which is a condition for some tax credits. Box 9: Reports if you are a graduate student, which also matters for credit eligibility. It's essential to cross-reference these reported figures with your own records for accuracy when preparing your tax return. Mistakes on the IRS 1098-T Form Filing your taxes can already feel daunting, and inaccuracies or omissions can compound the stress. Here are common pitfalls encountered when individuals prepare their taxes and the instructions for the 1098-T form to help you prevent these errors: A frequent blunder involves misunderstanding Box 1 and Box 5. Many tax filers overlook that scholarships or grants reported in Box 5 should be deducted from the amounts paid in Box 1 to determine net qualified education expenses. It's advisable to carefully review the instructions for Form 1098-T to ensure accurate calculations. Make sure to provide your correct Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN) to your educational institution. Missing or inaccurate taxpayer identification numbers can cause processing delays and affect your ability to claim tax benefits. Lastly, frequent misconceptions exist regarding who should receive the form. If you are claimed as a dependent, the 1098-T IRS instructions are clear that the educational tax credits associated with this form should be claimed by the taxpayer who is entitled to claim you as a dependent, which is usually the parent or guardian, not by the student. If you are not claimed as a dependent, then you may be eligible to claim the credit on your tax return. By familiarizing yourself with tax form 1098-T instructions, you can effectively navigate the complexities of education-related tax credits and optimize your returns. As always, it's wise to consult a tax professional if you're unsure about any aspect of your tax filing. They can offer tailored advice specific to your financial situation and ensure that your educational expenses are accurately reported and utilized for tax purposes. Fill Now

1098-T Form Instructions It's essential to stay informed on tax forms and their applications to manage your yearly filings better. One form that often comes into play for students or parents is the IRS Form 1098-T. This particular document serves a vital purpose in the United States tax system, playing a significant role for those involved with higher education expenses. Educational institutions use it to report the amount of expenses paid by a student during the tax year. It's important to note that this form is not just necessary, but it's often mandatory for any taxpayer who wishes to claim education credits like the American Opportunity Credit or the Lifetime Learning Credit. Filling Out Form 1098-T: Key Elements When dealing with the 1098-T form instructions, it is crucial to focus on several critical elements to ensure accurate reporting and to maximize potential tax benefits: Box 1: This box reports the amount of qualified tuition and other expenses paid during the tax year. Box 2: This box is used to show amounts billed for qualified tuition and related expenses but has been phased out in favor of reporting actual payments. Box 5: Scholarships or grants received; these are subtracted from your qualified expenses since they represent amounts that do not need to be repaid. Box 8: Indicates if you are enrolled at least half-time in a degree program, which is a condition for some tax credits. Box 9: Reports if you are a graduate student, which also matters for credit eligibility. It's essential to cross-reference these reported figures with your own records for accuracy when preparing your tax return. Mistakes on the IRS 1098-T Form Filing your taxes can already feel daunting, and inaccuracies or omissions can compound the stress. Here are common pitfalls encountered when individuals prepare their taxes and the instructions for the 1098-T form to help you prevent these errors: A frequent blunder involves misunderstanding Box 1 and Box 5. Many tax filers overlook that scholarships or grants reported in Box 5 should be deducted from the amounts paid in Box 1 to determine net qualified education expenses. It's advisable to carefully review the instructions for Form 1098-T to ensure accurate calculations. Make sure to provide your correct Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN) to your educational institution. Missing or inaccurate taxpayer identification numbers can cause processing delays and affect your ability to claim tax benefits. Lastly, frequent misconceptions exist regarding who should receive the form. If you are claimed as a dependent, the 1098-T IRS instructions are clear that the educational tax credits associated with this form should be claimed by the taxpayer who is entitled to claim you as a dependent, which is usually the parent or guardian, not by the student. If you are not claimed as a dependent, then you may be eligible to claim the credit on your tax return. By familiarizing yourself with tax form 1098-T instructions, you can effectively navigate the complexities of education-related tax credits and optimize your returns. As always, it's wise to consult a tax professional if you're unsure about any aspect of your tax filing. They can offer tailored advice specific to your financial situation and ensure that your educational expenses are accurately reported and utilized for tax purposes. Fill Now -

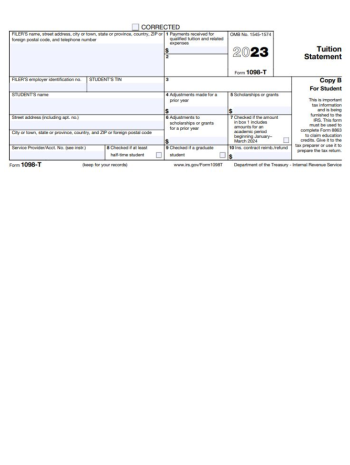

![image]() 1098-T Printable Tax Form When it comes to educational expenses, the IRS provides certain tax benefits that can reduce your taxable income. One of the key documents in this process is the 1098-T tax form, known as the Tuition Statement. The design of the 1098-T printable tax form is straightforward, comprising several vital sections that need to be completed accurately to avail of tax credits or deductions. The form itself has boxes for reporting amounts related to educational costs. Key sections include payments received for qualified tuition and related expenses, amounts billed for qualified tuition and related expenses, and any adjustments from previous years for these amounts. Scholarships and grants the student has received are also reported on the printable tax form 1098-T, as well as adjustments to scholarships or grants from the prior year. Guidelines for Completing the 1098-T Form Ensure that the student's Social Security Number (SSN) and personal information are accurate to prevent delays. Verify the amounts reported in Box 1 for payments received and Box 2 for amounts billed to ensure they accurately reflect the amounts related to qualified tuition and related expenses. Report any scholarships or grants in Box 5. These should only include the funds that the student was awarded and/or received during the tax year. Do not overlook Boxes 4 and 6, as they deal with adjustments made for prior years that can affect your current year's tax credits or deductions. Review the entire form for completeness and accuracy before printing. How to File the 1098-T Printable Form The procedure to submit your completed 1098-T form is quite systematic. Here's a step-by-step guide: After ensuring all parts of your printable 1098-T tuition statement are correct, download and print the form from our website. If you are a service provider (such as an educational institution), you must furnish one copy to the IRS and one copy to the student. Attach the IRS copy of the form with your tax return if filing by paper. Electronic filings do not require attachments; the form should be on hand if requested. Secure the student copy of the form for your records and provide it to them so they can use the information when preparing their return. Deadline for 2023 Form 1098-T Submission To remain compliant, it's important to know when to print the 1098-T tax form and submit it. Educational institutions are required to issue the 1098-T form to students by January 31 for the tuition paid in the preceding tax year. For submitting the form to the IRS, electronic filers have until March 31, while paper filers must submit by February 28. Remember that timely submission of the 2023 1098-T form printable can aid in the smoother processing of tax benefits related to education. Make sure to consult our comprehensive list of resources and obtain all the necessary forms from our website to ensure you are well-prepared for tax season. Fill Now

1098-T Printable Tax Form When it comes to educational expenses, the IRS provides certain tax benefits that can reduce your taxable income. One of the key documents in this process is the 1098-T tax form, known as the Tuition Statement. The design of the 1098-T printable tax form is straightforward, comprising several vital sections that need to be completed accurately to avail of tax credits or deductions. The form itself has boxes for reporting amounts related to educational costs. Key sections include payments received for qualified tuition and related expenses, amounts billed for qualified tuition and related expenses, and any adjustments from previous years for these amounts. Scholarships and grants the student has received are also reported on the printable tax form 1098-T, as well as adjustments to scholarships or grants from the prior year. Guidelines for Completing the 1098-T Form Ensure that the student's Social Security Number (SSN) and personal information are accurate to prevent delays. Verify the amounts reported in Box 1 for payments received and Box 2 for amounts billed to ensure they accurately reflect the amounts related to qualified tuition and related expenses. Report any scholarships or grants in Box 5. These should only include the funds that the student was awarded and/or received during the tax year. Do not overlook Boxes 4 and 6, as they deal with adjustments made for prior years that can affect your current year's tax credits or deductions. Review the entire form for completeness and accuracy before printing. How to File the 1098-T Printable Form The procedure to submit your completed 1098-T form is quite systematic. Here's a step-by-step guide: After ensuring all parts of your printable 1098-T tuition statement are correct, download and print the form from our website. If you are a service provider (such as an educational institution), you must furnish one copy to the IRS and one copy to the student. Attach the IRS copy of the form with your tax return if filing by paper. Electronic filings do not require attachments; the form should be on hand if requested. Secure the student copy of the form for your records and provide it to them so they can use the information when preparing their return. Deadline for 2023 Form 1098-T Submission To remain compliant, it's important to know when to print the 1098-T tax form and submit it. Educational institutions are required to issue the 1098-T form to students by January 31 for the tuition paid in the preceding tax year. For submitting the form to the IRS, electronic filers have until March 31, while paper filers must submit by February 28. Remember that timely submission of the 2023 1098-T form printable can aid in the smoother processing of tax benefits related to education. Make sure to consult our comprehensive list of resources and obtain all the necessary forms from our website to ensure you are well-prepared for tax season. Fill Now -

![image]() Tax Form 1098-T When embarking on higher education, students often encounter the student 1098-T tax form, which is pivotal during tax season. This form, issued by educational institutions, details the tuition and related expenses paid by or billed to students. It plays a crucial role in determining eligibility for education-related tax benefits. Real-Life Application of Form 1098-T Consider Jane, a part-time college student. She receives her college tax form 1098-T showcasing the tuition fees she paid. Jane uses this information to claim the American Opportunity Tax Credit, reducing her tax liability significantly. Meanwhile, Mark, a graduate student, gets the 1098-T tax form and applies it towards the Lifetime Learning Credit for a deduction on his taxable income. Implications of Financial Decisions on Form 1098-T Financial decisions directly impact the data reported on the 1098-T form. For example, scholarships and grants reduce the amount of reported educational expenses. If a student like Alex pays his tuition using these awards, the deducted amount on his tax return will be less than someone who paid out of pocket or with loans. Maximizing Deductions with the 1098-T Form Taxpayers seeking to maximize their deductions must understand the intricacies of the 1098-T form. Students can optimize their eligible claims by coordinating the timing of tuition payments and understanding how different types of aid are reported. It is also essential to consider the tax implications when opting for a tuition payment plan or educational loan. Compliant Utilization of Form 1098-T Maintaining compliance is paramount when claiming deductions with the 1098-T. Taxpayers must ensure the amounts claimed match the expenditures reported by their educational institution. Incorrectly filed information can lead to an audit or penalties from the IRS. Several related documents and information are essential for accurate reporting and compliance: Tuition Statements (Invoices/Receipts)Original statements from educational institutions detailing tuition and fees paid during the tax year. Enrollment RecordsDocuments confirming enrollment status, such as transcripts or registration receipts. Scholarship or Grant InformationDetails of any scholarships or grants received, as they may affect the taxable portion of educational assistance. Student Loan Interest Statements (1098-E)If applicable, documentation reflecting the interest paid on student loans, potentially impacting deductions. Obtaining a Blank Tax Form 1098-T At times, students may not receive their 1098-T form due to various reasons, such as a change of address. If you need to get the tax form 1098-T blank, it's readily available on our website. You can manually calculate and report the necessary information on your tax return by downloading this statement. Visualizing the 1098-T Tax Form Example To better understand how to fill out the statement, view a 1098-T tax form example that will guide you through the kind of information needed and where to place it on the template, ensuring accuracy when you claim your educational deductions. Fill Now

Tax Form 1098-T When embarking on higher education, students often encounter the student 1098-T tax form, which is pivotal during tax season. This form, issued by educational institutions, details the tuition and related expenses paid by or billed to students. It plays a crucial role in determining eligibility for education-related tax benefits. Real-Life Application of Form 1098-T Consider Jane, a part-time college student. She receives her college tax form 1098-T showcasing the tuition fees she paid. Jane uses this information to claim the American Opportunity Tax Credit, reducing her tax liability significantly. Meanwhile, Mark, a graduate student, gets the 1098-T tax form and applies it towards the Lifetime Learning Credit for a deduction on his taxable income. Implications of Financial Decisions on Form 1098-T Financial decisions directly impact the data reported on the 1098-T form. For example, scholarships and grants reduce the amount of reported educational expenses. If a student like Alex pays his tuition using these awards, the deducted amount on his tax return will be less than someone who paid out of pocket or with loans. Maximizing Deductions with the 1098-T Form Taxpayers seeking to maximize their deductions must understand the intricacies of the 1098-T form. Students can optimize their eligible claims by coordinating the timing of tuition payments and understanding how different types of aid are reported. It is also essential to consider the tax implications when opting for a tuition payment plan or educational loan. Compliant Utilization of Form 1098-T Maintaining compliance is paramount when claiming deductions with the 1098-T. Taxpayers must ensure the amounts claimed match the expenditures reported by their educational institution. Incorrectly filed information can lead to an audit or penalties from the IRS. Several related documents and information are essential for accurate reporting and compliance: Tuition Statements (Invoices/Receipts)Original statements from educational institutions detailing tuition and fees paid during the tax year. Enrollment RecordsDocuments confirming enrollment status, such as transcripts or registration receipts. Scholarship or Grant InformationDetails of any scholarships or grants received, as they may affect the taxable portion of educational assistance. Student Loan Interest Statements (1098-E)If applicable, documentation reflecting the interest paid on student loans, potentially impacting deductions. Obtaining a Blank Tax Form 1098-T At times, students may not receive their 1098-T form due to various reasons, such as a change of address. If you need to get the tax form 1098-T blank, it's readily available on our website. You can manually calculate and report the necessary information on your tax return by downloading this statement. Visualizing the 1098-T Tax Form Example To better understand how to fill out the statement, view a 1098-T tax form example that will guide you through the kind of information needed and where to place it on the template, ensuring accuracy when you claim your educational deductions. Fill Now